Legacy Planning Navigating Trusts and Estates Success

3 min read

Crafting a Lasting Legacy: A Guide to Trusts and Estates

Navigating the intricate landscape of trusts and estates is akin to sculpting a legacy that stands the test of time. From wealth preservation to ensuring the seamless transfer of assets, understanding the nuances of trusts and estates is paramount for individuals seeking to leave a lasting impact.

Trusts: Foundations of Estate Planning

Trusts serve as the cornerstone of effective estate planning. These legal entities enable individuals to protect and distribute their assets according to their wishes. Establishing trusts involves careful consideration of individual circumstances, financial goals, and the needs of beneficiaries. Trusts provide a flexible and private means of wealth management.

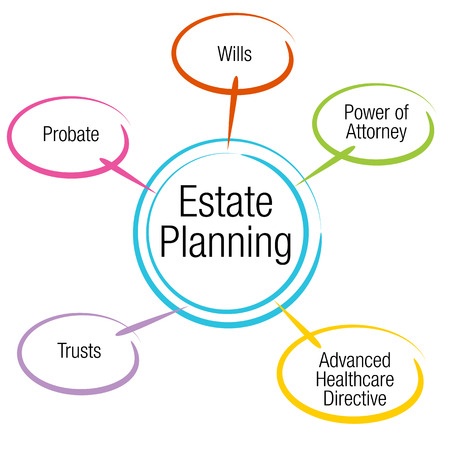

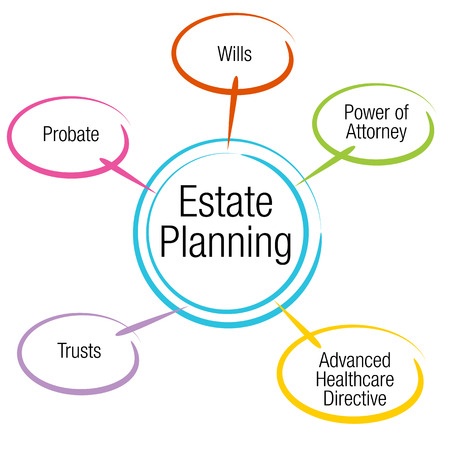

Estate Planning: Beyond Wills and Probate

Estate planning extends beyond the simplicity of wills and probate. While a will outlines the distribution of assets after death, comprehensive estate planning involves various tools such as trusts, powers of attorney, and healthcare directives. Navigating the legal intricacies demands a holistic approach to ensure that every aspect of an individual’s estate is accounted for.

Revocable vs. Irrevocable Trusts: Weighing Options

Understanding the distinction between revocable and irrevocable trusts is fundamental in estate planning. Revocable trusts offer flexibility, allowing modifications during the individual’s lifetime, while irrevocable trusts provide greater asset protection but come with more rigid terms. Choosing between the two involves a careful assessment of individual goals and preferences.

Wealth Preservation: Minimizing Tax Implications

Wealth preservation is a key objective in trusts and estates planning. The strategic use of trusts can help minimize tax implications, ensuring that assets pass efficiently to beneficiaries. Trusts provide opportunities for tax planning, asset protection, and the preservation of family wealth for future generations.

Specialized Trusts: Tailoring Solutions

Specialized trusts cater to unique circumstances and objectives. From charitable trusts that support philanthropic goals to special needs trusts designed to provide for disabled beneficiaries, the array of trust options allows individuals to tailor solutions that align with their values and priorities. Each specialized trust serves a distinct purpose in the broader estate plan.

Probate Avoidance: Streamlining the Process

Avoiding probate is a common goal in estate planning. Probate can be a lengthy and public process, and trusts offer a means to streamline the transfer of assets outside of probate court. Understanding the benefits of probate avoidance through trusts empowers individuals to plan for an efficient and private estate settlement.

Trusts and Estates and CGSMonitor: Staying Informed

Stay informed about trusts and estates by exploring CGSMonitor. Access a wealth of information to navigate the complexities of legacy planning, legal precedents, and industry trends. In the dynamic landscape of trusts and estates, knowledge is essential for making informed decisions.

Succession Planning: Business and Family Continuity

For individuals with businesses, succession planning is an integral aspect of trusts and estates. Creating a seamless transition for both family and business continuity involves utilizing trusts to facilitate the transfer of ownership and management. Trusts become instrumental in preserving the legacy of both wealth and business endeavors.

Estate Administration: Navigating Responsibilities

The administration of an estate involves various responsibilities, from asset valuation to debt settlement. Trusts play a crucial role in simplifying estate administration by providing clear guidelines for the distribution of assets. Understanding the nuances of estate administration ensures a smooth transition for heirs and beneficiaries.

Trends in Trusts and Estates: Adapting to Change

The landscape of trusts and estates is not static. Evolving legal, economic, and societal trends impact how individuals plan for their legacies. Staying abreast of these trends is crucial for adapting estate plans to changing circumstances and ensuring that trusts remain effective in achieving long-term objectives.

In the realm of trusts and estates, individuals embark on a journey to shape their legacy. From the foundations of trusts to the complexities of estate planning, the process demands careful consideration and expertise. Navigating this intricate landscape is a continuous endeavor, and staying informed through platforms like CGSMonitor provides a valuable resource for individuals sculpting a lasting legacy.